What is AML and Why It Matters in 2026

Last Updated on Feb 18, 2026, 2k Views

What is AML and Why It Matters in 2026

What is AML and Why It Matters in 2026

What is AML?

Anti-Money Laundering (AML) refers to the laws, regulations, and procedures designed to prevent criminals from disguising illegally obtained funds as legitimate income.

Money laundering typically involves three stages:

Placement – Introducing illicit funds into the financial system

Layering – Moving funds through complex transactions to hide the source

Integration – Reintroducing “cleaned” money into the economy

Globally, AML standards are largely shaped by the Financial Action Task Force (FATF), which sets international guidelines to combat money laundering and terrorist financing.

Why AML Matters More in 2026

1. Rise of Digital Payments & Fintech

With the rapid growth of digital banking, fintech platforms, and cross-border transactions, financial crime risks have expanded. In countries like India, the surge in UPI and digital wallets has increased the need for real-time transaction monitoring.

2. Cryptocurrency & Virtual Assets

Cryptocurrencies and DeFi platforms present new AML challenges. Regulators worldwide are tightening oversight of Virtual Asset Service Providers (VASPs) to ensure transparency and compliance.

3. Stricter Global Regulations

Countries are strengthening AML enforcement. For example:

In India, AML enforcement is governed under the Prevention of Money Laundering Act (PMLA).

In the United States, AML compliance is largely driven by the Bank Secrecy Act (BSA).

Regulators are imposing heavier fines and holding senior management personally accountable for compliance failures.

4. Focus on Ultimate Beneficial Ownership (UBO)

Shell companies and complex ownership structures are increasingly scrutinized. Regulators now demand clear identification of the real individuals who ultimately control or benefit from a business.

5. AI & Advanced Monitoring

In 2026, AI-powered transaction monitoring systems are becoming standard. Financial institutions use machine learning to detect suspicious patterns faster and reduce false positives.

Key Components of AML Compliance

KYC (Know Your Customer) – Verifying customer identity

CDD (Customer Due Diligence) – Assessing customer risk

Enhanced Due Diligence (EDD) – For high-risk clients

Transaction Monitoring – Ongoing risk detection

Suspicious Activity Reporting (SAR) – Reporting to authorities

Why AML Is Critical for Businesses

1. Avoid Heavy Penalties

Regulatory fines can run into millions (or billions) of dollars.

2. Protect Reputation

AML failures damage trust and investor confidence.

3. Prevent Criminal Exploitation

Strong AML controls prevent businesses from being used for fraud, corruption, tax evasion, and terrorist financing.

4. Ensure Global Market Access

Non-compliant institutions may lose correspondent banking relationships or international partnerships.

Conclusion

In 2026, AML is no longer just a regulatory requirement—it is a strategic necessity. With digital finance expanding and regulatory scrutiny intensifying, businesses must adopt a proactive, technology-driven, and risk-based AML framework.

If you’re creating AML-focused content (as you’ve been doing recently), this topic works well as a pillar blog post that links to subtopics like KYC, UBO, AI in AML, FATF guidelines, and crypto risks.

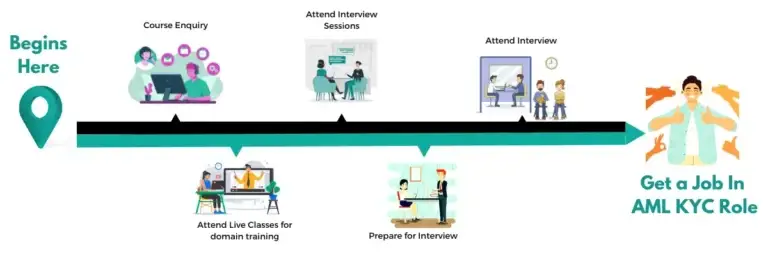

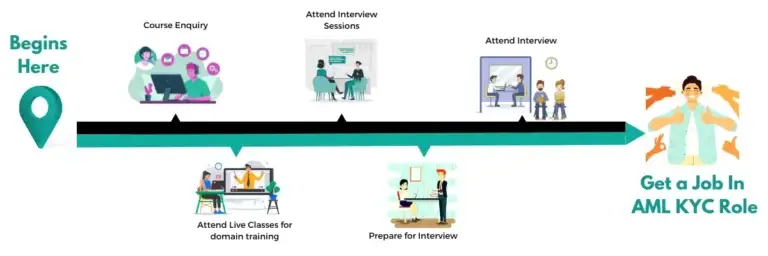

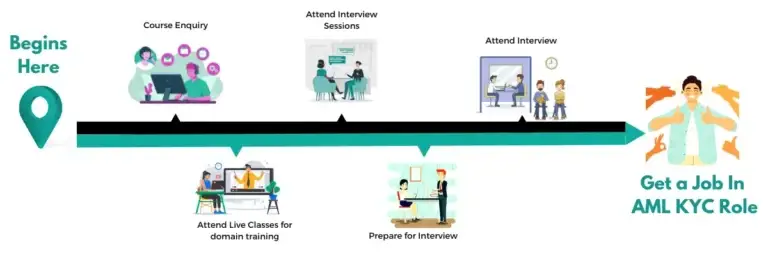

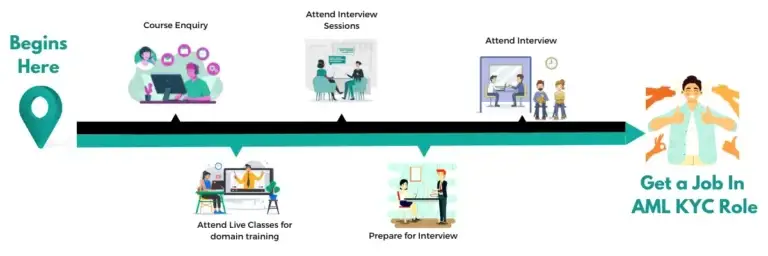

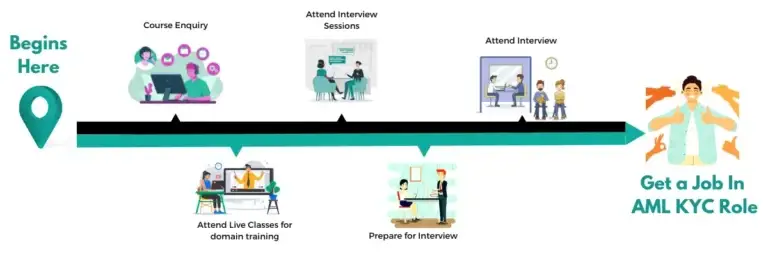

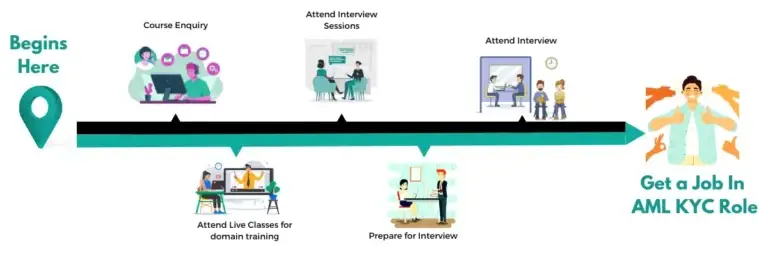

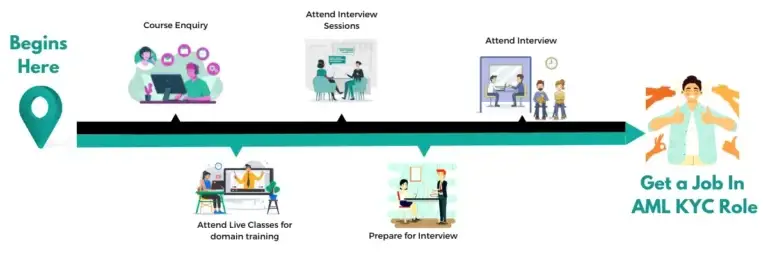

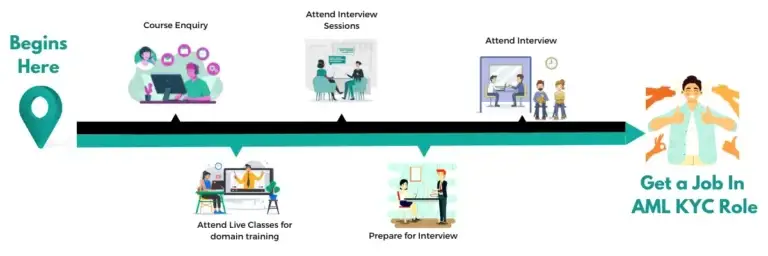

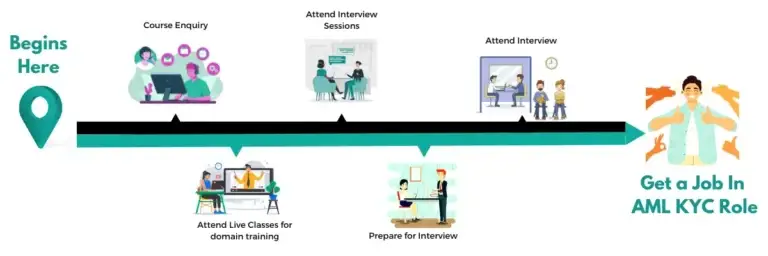

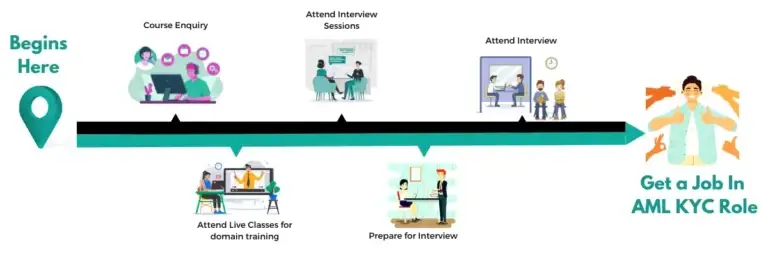

Career Advice!

Feel Free to Contact Us or WhatsApp Us for Career Counseling!

- +91 9066508122

Data Science Interview Questions

Data Science Interview Questions Data Science Interview Questions 1. What...

Read MoreTop 30 DevOps Interview Questions & Answers (2022 Update)

Top 30 DevOps Interview Questions & Answers (2022 Update) Top...

Read MoreAnti Money Laundering Interview Questions

Anti Money Laundering Interview Questions Anti Money Laundering Interview Questions...

Read More