Data Science Interview Questions Data Science Interview Questions 1. What...

Read More4. Focus on Ultimate Beneficial Ownership (UBO)

Shell companies and complex ownership structures are increasingly scrutinized. Regulators now demand clear identification of the real individuals who ultimately control or benefit from a business.

5. AI & Advanced Monitoring

In 2026, AI-powered transaction monitoring systems are becoming standard. Financial institutions use machine learning to detect suspicious patterns faster and reduce false positives.

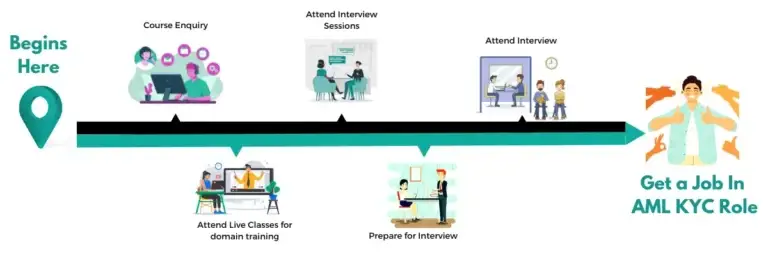

Key Components of AML Compliance

KYC (Know Your Customer) – Verifying customer identity

CDD (Customer Due Diligence) – Assessing customer risk

Enhanced Due Diligence (EDD) – For high-risk clients

Transaction Monitoring – Ongoing risk detection

Suspicious Activity Reporting (SAR) – Reporting to authorities