Data Science Interview Questions Data Science Interview Questions 1. What...

Read MoreWhat are the questions we expect in aml kyc interview

Last Updated on Aug 13, 2025, 2k Views

What are the questions we expect in aml kyc interview

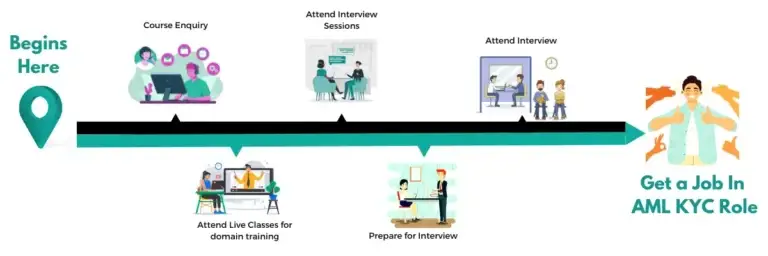

In an AML/KYC interview, you can expect a mix of technical, scenario-based, and regulatory knowledge questions, along with a few about your experience and soft skills.

1. Basic AML/KYC Knowledge

These test your understanding of fundamental concepts.

What is AML and why is it important?

Can you explain the difference between AML, CFT, and KYC?

What is CDD and EDD? Give examples of when each is required.

What are PEPs and how do you identify them?

Can you name some global sanction lists used in AML checks?

2. Regulatory Frameworks

Checks your familiarity with laws and standards.

What is the FATF and what is its role?

What is the purpose of the 5th/6th EU AML Directive?

Can you explain the USA PATRIOT Act’s relevance to AML?

What are OFAC sanctions? How do they affect onboarding?

Difference between AML regulations in your country and internationally.

3. Practical KYC/Onboarding Process

Tests your operational knowledge.

Walk me through the KYC process for a new corporate client.

How do you verify the Ultimate Beneficial Owner (UBO)?

How would you handle missing or inconsistent customer documents?

What’s the difference between onboarding an individual vs. a corporate client?

4. Transaction Monitoring & Red Flags

Looks at your investigative and analytical thinking.

Name 5 red flags for money laundering in transactions.

How do you investigate a suspicious transaction alert?

How do you differentiate between a false positive and a true hit in screening?

What are typologies of terrorist financing?

5. Sanctions & Screening

Focuses on handling matches and escalations.

What steps do you take if a customer matches a sanctions list?

What’s the difference between a hard match and a soft match?

How would you investigate a PEP match?

6. Scenario-Based Problem Solving

Tests your judgment under realistic conditions.

A client refuses to provide their source of funds — what do you do?

You notice a large transaction inconsistent with the client’s profile — what’s next?

You get a hit on a sanctions list during ongoing monitoring — how do you handle it?

Career Advice!

Feel Free to Contact Us or WhatsApp Us for Career Counseling!

- +91 9066508122

7. Tools & Systems

Checks if you’ve used AML/KYC software.

Which KYC/AML platforms have you worked with? (e.g., World-Check, Actimize, Dow Jones, LexisNexis)

How do you conduct adverse media screening?

8. Soft Skills & Compliance Culture

Assesses your integrity, communication, and teamwork.

How do you handle pressure during high-volume alert periods?

How do you ensure compliance with tight deadlines?

Give an example of when you identified a risk others missed.

Top 30 DevOps Interview Questions & Answers (2022 Update)

Top 30 DevOps Interview Questions & Answers (2022 Update) Top...

Read MoreAnti Money Laundering Interview Questions

Anti Money Laundering Interview Questions Anti Money Laundering Interview Questions...

Read More