Data Science Interview Questions Data Science Interview Questions 1. What...

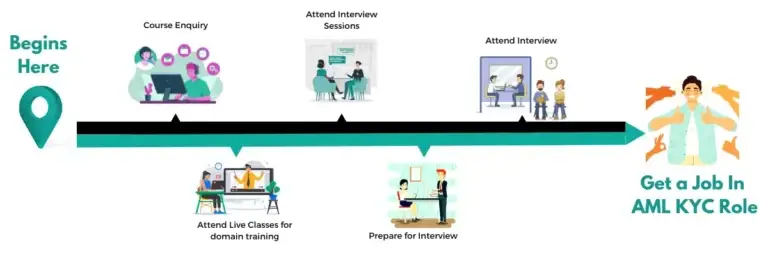

Read MoreWhat are skills required to land in aml kyc domain.

Last Updated on Aug 13, 2025, 2k Views

What are skills required to land in AML KYC domain.

1. Regulatory & Compliance Knowledge

AML/CFT Regulations – Understanding laws like FATF Recommendations, USA PATRIOT Act, EU AMLDs, Indian PMLA, etc.

KYC/Customer Due Diligence (CDD) – Process of verifying customers, risk categorization, and ongoing monitoring.

Sanctions Compliance – Familiarity with OFAC, UN, EU, HMT lists and how to screen for them.

PEP & Adverse Media Checks – Screening processes for politically exposed persons and negative news.

Risk Assessment Frameworks – High-risk jurisdictions, products, services, and transaction patterns.

2. Analytical & Investigation Skills

Transaction Monitoring – Identifying suspicious patterns, unusual spikes, or layering activity.

Alert Review & Escalation – Deciding whether to close, escalate, or investigate alerts.

Case Management – Documenting findings clearly for audit/regulatory review.

Data Interpretation – Using financial data, account statements, and SWIFT/transaction records to find anomalies.

3. Technical & Tool Proficiency

Screening Tools – World-Check, Dow Jones Risk & Compliance, Accuity, Refinitiv, ComplyAdvantage, etc.

Transaction Monitoring Systems – Actimize, SAS AML, Fiserv, Oracle Mantas, etc.

Banking Platforms – Core banking systems and CRM tools.

Excel & Data Handling – Pivot tables, filtering, and analysis for large datasets.

4. Communication & Documentation

Report Writing – Drafting clear Suspicious Transaction Reports (STR/SAR).

Regulatory Liaison – Communicating with regulators or internal compliance teams.

Client Interaction – Gathering KYC documents and clarifying information without breaching confidentiality.

5. Soft Skills

Attention to Detail – Missing small red flags can have major compliance consequences.

Problem-Solving – Assessing complex cases where rules may be unclear.

Time Management – Handling high alert volumes within strict deadlines.

Ethical Judgment – Making compliance decisions without bias or pressure.

6. Qualifications & Certifications (Bonus)

Certifications –

CAMS (Certified Anti-Money Laundering Specialist)

CKYCA (Certified KYC Associate)

CFE (Certified Fraud Examiner)

ICA Certificates in AML/KYC

Academic Background – Finance, Law, Economics, Accounting, or Risk Management.

Career Advice!

Feel Free to Contact Us or WhatsApp Us for Career Counseling!

- +91 9066508122

Top 30 DevOps Interview Questions & Answers (2022 Update)

Top 30 DevOps Interview Questions & Answers (2022 Update) Top...

Read MoreAnti Money Laundering Interview Questions

Anti Money Laundering Interview Questions Anti Money Laundering Interview Questions...

Read More