Data Science Interview Questions Data Science Interview Questions 1. What...

Read MoreUnderstanding Prevention of Money Laundering Act (PMLA)

Last Updated on Feb 16, 2026, 2k Views

Understanding Prevention of Money Laundering Act (PMLA)

Understanding the Prevention of Money Laundering Act (PMLA)

The Prevention of Money Laundering Act, 2002 (PMLA) is India’s primary legislation to combat money laundering and prevent the use of the financial system for illegal activities. It came into force on 1 July 2005 and has been amended multiple times to strengthen enforcement.

1️⃣ Objective of PMLA

The Act aims to:

Prevent and control money laundering

Confiscate and attach property derived from crime

Combat financing of terrorism

Align India with global AML standards (e.g., FATF recommendations)

2️⃣ What is Money Laundering under PMLA?

Under Section 3 of the Act, money laundering involves:

Direct or indirect involvement in proceeds of crime

Concealment, possession, acquisition, or use of such proceeds

Projecting or claiming tainted money as untainted (legitimate)

Simply put: Converting illegal money into “clean” money

3️⃣ Key Authorities under PMLA

Enforcement Directorate (ED) – Investigates money laundering cases

Adjudicating Authority – Confirms attachment of properties

Special Courts – Conduct trials under PMLA

The ED has powers of search, seizure, arrest, and provisional attachment of property.

4️⃣ Important Features of PMLA

🔹 A. Attachment of Property

Authorities can provisionally attach property suspected to be derived from crime for 180 days.

🔹 B. Scheduled Offences

Money laundering is linked to underlying crimes listed in the Schedule (e.g., corruption, fraud, drug trafficking, terrorism, tax evasion).

🔹 C. Reporting Entities

The following must comply with AML obligations:

Banks

Financial Institutions

Intermediaries

Designated Non-Financial Businesses and Professions (DNFBPs)

🔹 D. Record-Keeping & KYC

Entities must:

Maintain transaction records

Conduct Customer Due Diligence (CDD)

Report suspicious transactions to the Financial Intelligence Unit (FIU-IND)

5️⃣ Punishment under PMLA

3 to 7 years imprisonment

Up to 10 years in certain cases (e.g., drug-related offences)

Fine (no statutory upper limit)

6️⃣ Recent Developments

Recent amendments have:

Expanded definition of reporting entities

Strengthened ED’s powers

Included certain offences under Companies Act and GST

Brought cryptocurrency exchanges under AML reporting requirements

7️⃣ Why PMLA is Important

Protects financial integrity

Prevents black money circulation

Supports anti-terror financing measures

Enhances international credibility

8️⃣ Practical Impact on Businesses

Organizations must:

✔ Implement AML compliance programs

✔ Appoint a Principal Officer

✔ Conduct regular risk assessments

✔ File Suspicious Transaction Reports (STRs)

✔ Train employees on AML obligations

Non-compliance can result in heavy penalties and reputational damage.

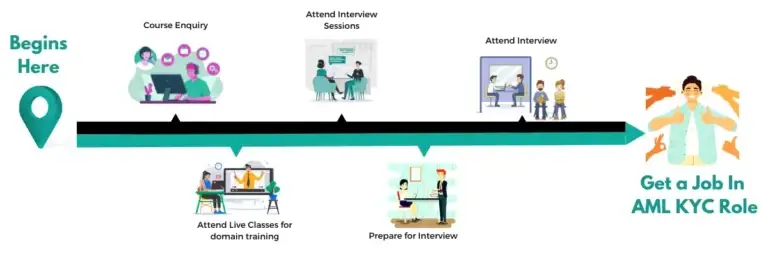

Career Advice!

Feel Free to Contact Us or WhatsApp Us for Career Counseling!

- +91 9066508122

Top 30 DevOps Interview Questions & Answers (2022 Update)

Top 30 DevOps Interview Questions & Answers (2022 Update) Top...

Read MoreAnti Money Laundering Interview Questions

Anti Money Laundering Interview Questions Anti Money Laundering Interview Questions...

Read More