Data Science Interview Questions Data Science Interview Questions 1. What...

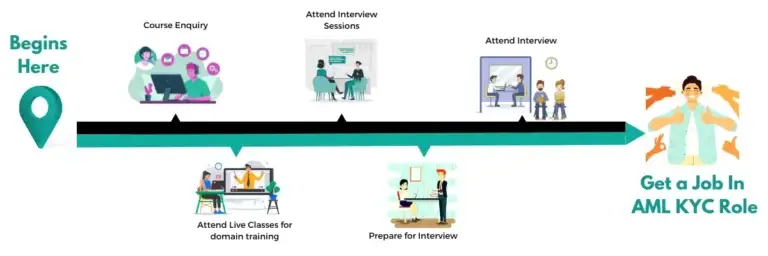

Read MoreKYC and Risk-Based Approach

Global regulators advocate a risk-based approach, particularly under guidance from the Financial Action Task Force. This means:

Low-risk customers → Simplified due diligence

Medium-risk customers → Standard due diligence

High-risk customers → Enhanced due diligence

This approach allows institutions to allocate compliance resources effectively.

Digital KYC & Emerging Trends

Technology has transformed KYC processes through:

AI-driven identity verification

e-KYC and remote onboarding

Blockchain-based identity systems

Continuous transaction monitoring

Regulators worldwide are encouraging digital compliance frameworks while maintaining strict security standards.