Data Science Interview Questions Data Science Interview Questions 1. What...

Read MoreIndia AML Compliance Landscape – 2025 Update

Last Updated on Aug 04, 2025, 2k Views

India AML Compliance Landscape – 2025 Update

1.Regulatory Frame work

Prevention of Money Laundering Act (PMLA), 2002

- Core legislation for AML/CFT enforcement.

- Enforced by the Enforcement Directorate (ED).

- Covers reporting entities like banks, financial institutions, intermediaries, real estate, and crypto service providers.

- Financial Intelligence Unit – India (FIU-IND)

- Collects, analyzes, and disseminates financial intelligence.

- Receives Suspicious Transaction Reports (STRs), Cash Transaction Reports (CTRs), etc.

- Reserve Bank of India (RBI) Master Directions (updated 2023–2025)

- Enhanced focus on risk-based KYC, beneficial ownership transparency, and ongoing due diligence.

- Mandates robust transaction monitoring and sanctions screening.

- SEBI and IRDAI Guidelines

- Sector-specific AML/CFT obligations for securities and insurance firms.

2. Key 2025 Updates

- VDA (Virtual Digital Assets) under PML

- As of March 2023, crypto exchanges and VDA service providers are “reporting entities”.

- In 2025, compliance obligations have been intensified, including stricter KYC, reporting, and suspicious activity monitoring.

- Expanded Beneficial Ownership Norms

- Enhanced due diligence for entities with complex structures

- Focus on identifying ultimate beneficial owners (UBOs) – especially in cross-border contexts.

- Alignment with FATF Recommendations

- India continues aligning regulations with FATF 40 Recommendations.

- Enhanced scrutiny on non-profit organizations (NPOs) and cross-border transactions.

- Real Estate and High-Value Dealers

- Compliance frameworks expanded to cover high-risk non-financial sectors, including jewelry, real estate, and luxury goods dealers.

- Enhanced STR Requirements

- Reporting threshold rationalized for better surveillance.

- Stronger emphasis on pattern-based red flags, network analysis, and behavioral risk indicators.

Technology and Compliance Trends

AI-based Transaction Monitoring: Growing adoption among banks and fintechs.

e-KYC Integration: Aadhaar-based and PAN-based digital KYC preferred.

Blockchain Surveillance Tools: Used for VDA compliance and risk tracking.

Sanctions & PEP Screening Automation: More entities deploying global watchlist monitoring tools.

Challenges for Institutions

Managing complex UBO structures and shell companies.

Ensuring AML compliance in rural/digital lending models.

Keeping up with evolving typologies in cyber fraud and mule accounts.

Maintaining a compliance-ready audit trail amid increasing enforcement actions.

Best Practices for 2025

Adopt a risk-based AML program, tailored to the institution’s size and risk profile.

Continuous employee training and scenario-based alert investigation.

Automate STR/CTR generation and case management workflows.

Regular internal audits and gap assessments against PMLA, RBI, and FIU standards.

Engage with RegTech solutions for eKYC, onboarding, sanctions screening, and real-time monitoring.

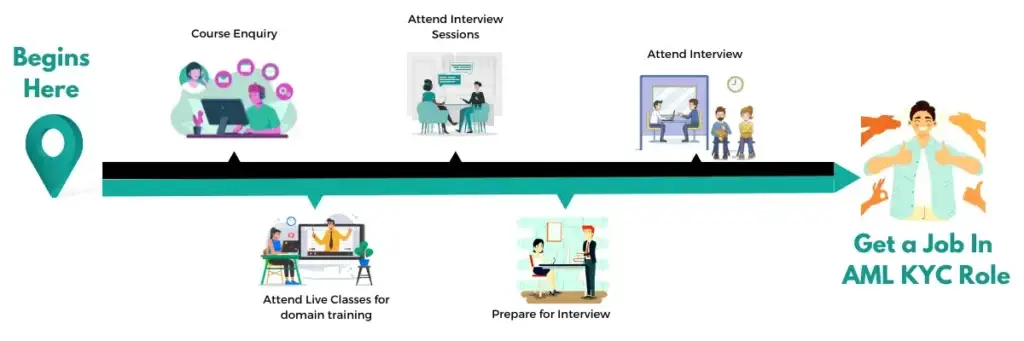

Career Advice!

Feel Free to Contact Us or WhatsApp Us for Career Counseling!

- +91 9066508122

Top 30 DevOps Interview Questions & Answers (2022 Update)

Top 30 DevOps Interview Questions & Answers (2022 Update) Top...

Read MoreAnti Money Laundering Interview Questions

Anti Money Laundering Interview Questions Anti Money Laundering Interview Questions...

Read More