Data Science Interview Questions Data Science Interview Questions 1. What...

Read MoreHow to prepare for AML KYC Job Interview for entry level

Last Updated on Aug 04, 2025, 2k Views

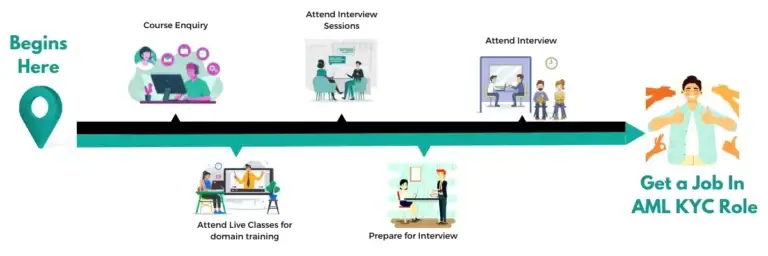

How to prepare for AML KYC Job Interview for entry level

Preparing for an AML/KYC entry-level job interview is all about showing that you:

Understand the basics of AML/KYC regulations,

Are detail-oriented and reliable,

Can follow procedures, analyze data, and document findings,

Are eager to learn and grow in compliance.

1. Master the Basics of AML/KYC

- Even at entry level, you’re expected to know:

- What AML and KYC mean

- Why financial institutions need to comply

- What is Customer Due Diligence (CDD) and Enhanced Due Diligence (EDD)

- What is a Suspicious Activity Report (SAR)

- What is Sanctions Screening

- What is PEP (Politically Exposed Person)

Learn Definitions & Scenarios:

FATF red flags

Real-life AML scandals (e.g., HSBC, Danske Bank)

What steps are followed when onboarding a customer

2. Review Common Interview Questions (with Sample Answers)

Technical/Knowledge-Based:

Q1: What is AML, and why is it important?

A: AML stands for Anti-Money Laundering. It’s a set of procedures and laws designed to stop criminals from disguising illegally obtained funds as legitimate income. It’s crucial for preventing terrorism financing, fraud, and other financial crimes.

Q2: What is KYC and what steps are involved?

A: KYC (Know Your Customer) is the process of verifying the identity of a customer. Key steps include: collecting ID documents, assessing risk, checking for PEP or sanctions, and ongoing monitoring.

Q3: What would you do if you spot a suspicious transaction?

A: I would escalate it to the compliance officer or senior analyst, document the transaction, and ensure it’s reviewed under the internal escalation protocol for a potential SAR filing.

Behavioral:

Q1: Tell me about a time you paid attention to small details.

Think about tasks that required accuracy—data entry, audits, proofreading, financial records, etc.

Q2: How do you handle repetitive tasks?

A: I focus on the importance of consistency and accuracy, and I try to keep my workflow efficient and organized. I take breaks to stay alert and avoid errors.

Q3: Are you comfortable working with sensitive data?

A: Yes, I understand the importance of confidentiality and follow data protection protocols strictly.

3. Be Familiar with AML Tools and Documents

You might not have hands-on experience, but you can still show awareness.

Know about:

KYC documents (passports, utility bills, corporate documents)

Screening tools (World-Check, Dow Jones, ComplyAdvantage)

Transaction monitoring (basics: red flags, large cash transfers, structuring)

TIP: Mention any courses or simulations you’ve done—even free ones.

- Tailor Your Resume and Talking Points

- Even if you lack direct AML/KYC experience, highlight:

- Analytical skills (e.g., Excel, research, reporting)

- Communication (writing emails, documenting steps)

- Detail orientation (e.g., audits, finance, data entry)

- Trustworthiness (you’ll be handling confidential data)

Use phrases like: - “Reviewed documentation for compliance”

- “Ensured accuracy and completeness of records”

- “Flagged irregularities for further review”

5. Show You’re a Fast Learner with the Right Attitude - You may get questions like:

“You don’t have prior AML/KYC experience—why should we hire you?” - Be honest and confident:

- “While I haven’t worked in AML/KYC yet, I’ve done [courses/certification] and I’ve studied real-world cases. I’m very interested in compliance, I’m detail-oriented, and I’m fully committed to learning quickly and becoming a valuable part of the team.”

6. Prepare Questions to Ask Them - Always have 1–2 questions at the end to show interest:

- “What does a typical day look like for someone in this role?”

- “What tools or platforms does your team use for KYC or transaction monitoring?”

- “What training do you provide for new analysts?”

Summary: Last-Minute Checklist - To-Do Description

- Know the key AML/KYC terms CDD, EDD, SAR, PEP, sanctions

- Learn basic red flags Large cash, frequent transfers, shell companies

- Prepare behavioral stories Use STAR method: Situation, Task, Action, Result

- Practice explaining your motivation “Why AML/KYC?” “Why this company?”

- Dress professionally Even for virtual interviews

Career Advice!

Feel Free to Contact Us or WhatsApp Us for Career Counseling!

- +91 9066508122

Top 30 DevOps Interview Questions & Answers (2022 Update)

Top 30 DevOps Interview Questions & Answers (2022 Update) Top...

Read MoreAnti Money Laundering Interview Questions

Anti Money Laundering Interview Questions Anti Money Laundering Interview Questions...

Read More