Data Science Interview Questions Data Science Interview Questions 1. What...

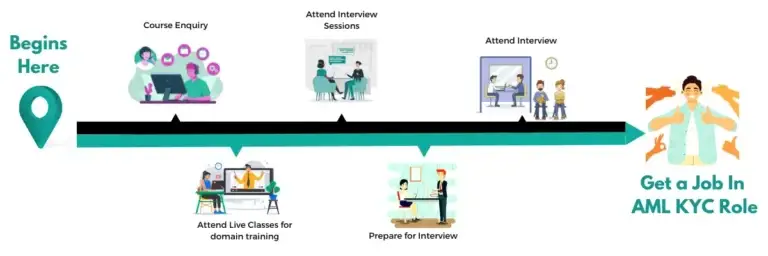

Read MoreHow challenging the aml kyc role will be for bankers

Last Updated on Aug 13, 2025, 2k Views

How challenging the aml kyc role will be for bankers

For bankers—especially those used to relationship management, lending, or branch operations—moving into an AML/KYC role can feel both rewarding and challenging. The challenge level really depends on three factors:

How steep the learning curve is for compliance concepts

How comfortable you are with analytical, investigative work

How fast-paced and high-volume the environment is

1. Mindset Shift: From Selling to Scrutinizing

Banking role: Often focuses on customer service, business development, and sales targets.

AML/KYC role: Prioritizes regulatory compliance, risk assessment, and saying “no” when risk is high.

Challenge: You’re no longer trying to make a deal happen—you’re trying to decide if it should happen at all.

2. Technical & Regulatory Complexity

You’ll need to quickly learn regulations like FATF, OFAC, EU AMLD, PMLA (India), and internal compliance policies.

KYC isn’t just “collecting documents”—it’s about understanding customer behavior, beneficial ownership, and source of funds.

Challenge: Regulations are constantly updated, so learning never stops.

3. Analytical & Investigative Skills

Tasks like reviewing transaction patterns, identifying red flags, and escalating suspicious cases require attention to detail and pattern recognition.

For bankers used to general account management, the shift to deep-dive investigations can be mentally demanding.

4. High Volume, Tight Deadlines

In large banks, you may handle dozens of alerts a day with strict SLA timelines.

Missing deadlines or overlooking a risk could lead to regulatory penalties—so the pressure is real.

5. Documentation & Audit Trail

Everything you do must be well-documented to satisfy regulators and internal audit teams.

Challenge: Bankers who are used to verbal decision-making may find the paperwork discipline intense.

✅ Why bankers succeed in AML/KYC:

Familiarity with customer profiles and products.

Understanding of banking transactions.

Strong interpersonal skills for communicating with clients during remediation or additional information requests.

🚀 Tip for Transitioning Bankers:

Get trained on AML red flags, typologies, and screening tools early.

Practice writing clear, concise investigative notes—a crucial AML skill.

Remember: in compliance, accuracy outweighs speed.

Career Advice!

Feel Free to Contact Us or WhatsApp Us for Career Counseling!

- +91 9066508122

Top 30 DevOps Interview Questions & Answers (2022 Update)

Top 30 DevOps Interview Questions & Answers (2022 Update) Top...

Read MoreAnti Money Laundering Interview Questions

Anti Money Laundering Interview Questions Anti Money Laundering Interview Questions...

Read More