Data Science Interview Questions Data Science Interview Questions 1. What...

Read MoreGlobal Aml Updates

Last Updated on Aug 04, 2025, 2k Views

Global AML Updates 2025

1. Financial Action Task Force (FATF)

Guidance update (June 22, 2025) on promoting financial inclusion through a risk‑based approach. It reinforces FATF Recommendation 1 and includes new case studies across sectors

High-risk listings (as of Feb–June 2025): The FATF “blacklist” still includes Iran, DPRK (North Korea), and Myanmar. The “grey list” now comprises 25 jurisdictions (e.g., Algeria, Angola, Kenya, Nepal, Venezuela)

2. European Union (EU)

- AMLR & AMLD6 rollout: Regulations 2024/1620 and 2024/1624 modernize AML/CFT rules. They strengthen beneficial ownership transparency, create centralized bank and securities registers, revise sanctions regimes, and expand supervisory powers. AMLA, the new EU AML Authority, will begin operations mid‑2025, with full functionality by 2028/29

- June 2025 delegated updates: The European Commission added new jurisdictions to its high-risk third-country list (e.g. Algeria, Kenya, Monaco), while delisting the UAE, Gibraltar, Barbados, Panama and others Financial Times

3. United States

FinCEN’s extended deadlines (July 2025): U.S. institutions now have until September 4, 2025, to implement prior notices related to Mexico-based financial groups

Investment Advisers now FIR-regulated: A final rule (published Sept 4, 2024) brings Registered Investment Advisers (RIAs) and Exempt Reporting Advisers (ERAs) under AML/CFT regimes. Compliance deadlines were extended to January 1, 2028 for full implementation, SAR filing, and enhanced program rollouts

Corporate Transparency Act review: Beneficial ownership reporting now affects only foreign entities; domestic filings are exempt, easing burdens on U.S.-based companies

4. United Kingdom

UK Money Laundering Advisory Notice update (March 27, 2025): HM Treasury revised its list of high-risk third countries following FATF’s plenary meeting earlier in 2025

FCA cash-based ML guidance (April 2, 2025): Financial Conduct Authority issued strengthened expectations for firms handling cash transactions and strengthening controls against cash-based laundering

5. Australia

- AML/CTF Bill 2024: Proposes expansion of AML/CTF scope to include professionals like lawyers and accountants. Failure to pass may risk Australia’s grey-listing by FATF in 2026. Frame includes risk-based proportionality for smaller firm

- Emerging Global Trends

- Tech & AI adoption: Regulators and firms are increasingly embracing real-time transaction monitoring, ML/AI-based risk scoring, and automation to scale AML effectiveness and reduce false positives

- Unified global standards: There’s movement toward harmonization via risk-based approaches and improved transparency—particularly in the EU and UK, which are aligning more closely with FATF standards

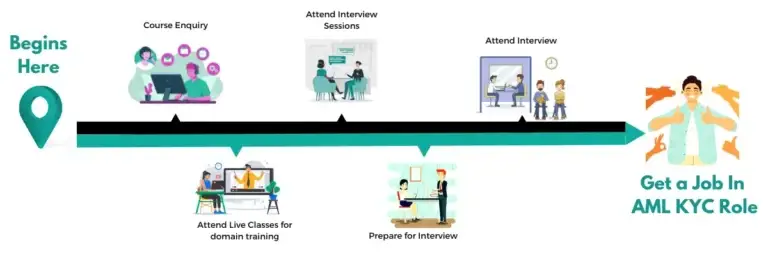

Career Advice!

Feel Free to Contact Us or WhatsApp Us for Career Counseling!

- +91 9066508122

Top 30 DevOps Interview Questions & Answers (2022 Update)

Top 30 DevOps Interview Questions & Answers (2022 Update) Top...

Read MoreAnti Money Laundering Interview Questions

Anti Money Laundering Interview Questions Anti Money Laundering Interview Questions...

Read More