Data Science Interview Questions Data Science Interview Questions 1. What...

Read MoreDid any one can switch career for aml kyc

Last Updated on Aug 13, 2025, 2k Views

Did any one can switch career for aml kyc

Yes — plenty of people switch into the AML/KYC field from completely different backgrounds.

It’s actually one of the few compliance-related domains where transferable skills matter as much as direct banking experience.

1. Common backgrounds of career switchers

Customer service / operations → Already familiar with handling client data and documentation.

Finance / accounting / audit → Good with numbers, risk assessment, and regulations.

IT / cybersecurity → Strong in data analysis, fraud detection systems, and technical compliance tools.

Legal / paralegal → Knowledge of regulations, contracts, and compliance frameworks.

2. Transferable skills that help

Attention to detail — spotting document discrepancies or suspicious transactions.

Analytical thinking — piecing together patterns in client activity.

Communication — clear reporting and escalation.

Tech savvy — using screening tools, databases, and case management systems.

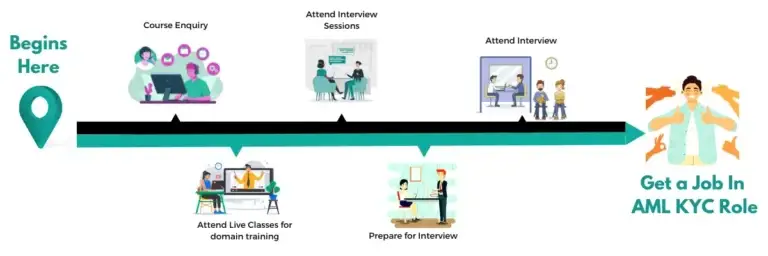

3. How people actually make the switch

Certifications: CAMS (Certified Anti-Money Laundering Specialist), CKYCA, ICA certifications, or local compliance courses.

Internal move: Many switch by applying for AML/KYC roles within their current bank or fintech.

Project involvement: Joining AML-related projects (client onboarding clean-ups, remediation work).

Contract/temporary roles: Short-term AML remediation projects often hire people from other fields.

Top 30 DevOps Interview Questions & Answers (2022 Update)

Top 30 DevOps Interview Questions & Answers (2022 Update) Top...

Read MoreAnti Money Laundering Interview Questions

Anti Money Laundering Interview Questions Anti Money Laundering Interview Questions...

Read More