Data Science Interview Questions Data Science Interview Questions 1. What...

Read MoreAML Regulations in the US: Overview of Bank Secrecy Act

Last Updated on Feb 16, 2026, 2k Views

AML Regulations in the US: Overview of Bank Secrecy Act

🇺🇸 AML Regulations in the US: Overview of the Bank Secrecy Act (BSA)

The foundation of Anti-Money Laundering (AML) regulation in the United States is the Bank Secrecy Act (BSA), enacted in 1970. It is the primary law requiring financial institutions to assist U.S. government agencies in detecting and preventing money laundering and terrorist financing.

1️⃣ What Is the Bank Secrecy Act?

The BSA, sometimes called the Currency and Foreign Transactions Reporting Act, establishes recordkeeping and reporting requirements for financial institutions to help identify suspicious financial activities.

It was significantly strengthened after the 9/11 attacks by the USA PATRIOT Act, which expanded AML compliance obligations.

2️⃣ Who Enforces the BSA?

The BSA is administered by the Financial Crimes Enforcement Network (FinCEN), a bureau of the U.S. Department of the Treasury.

Federal banking regulators that examine institutions for BSA compliance include:

Federal Reserve System (Fed)

Office of the Comptroller of the Currency (OCC)

Federal Deposit Insurance Corporation (FDIC)

3️⃣ Key Requirements Under the BSA

🔎 1. Customer Identification Program (CIP)

Financial institutions must verify the identity of customers opening accounts. This was introduced under the USA PATRIOT Act.

📋 2. Suspicious Activity Reports (SARs)

Institutions must file SARs when they detect suspicious transactions that may involve fraud, money laundering, or terrorist financing.

💵 3. Currency Transaction Reports (CTRs)

A CTR must be filed for cash transactions exceeding $10,000 in a single business day.

📁 4. Recordkeeping Requirements

Banks must maintain records of:

Cash purchases of negotiable instruments

Wire transfers

Foreign bank account relationships

🏢 5. AML Compliance Program

Financial institutions must implement a written AML program that includes:

Internal controls

Independent testing

Designated BSA/AML officer

Ongoing employee training

4️⃣ Institutions Covered Under the BSA

The BSA applies to more than just banks. Covered entities include:

Banks and credit unions

Money Services Businesses (MSBs)

Broker-dealers

Casinos

Virtual currency businesses

5️⃣ Penalties for Non-Compliance

Violations of the BSA can result in:

Civil monetary penalties (millions to billions of dollars)

Criminal penalties (fines and imprisonment)

Regulatory enforcement actions

Reputational damage

Major enforcement actions have been taken against global banks for AML failures.

6️⃣ Why the BSA Matters

The Bank Secrecy Act is the backbone of the U.S. AML framework. It enables authorities to:

Detect illicit financial flows

Combat drug trafficking and organized crime

Prevent terrorist financing

Enhance financial transparency

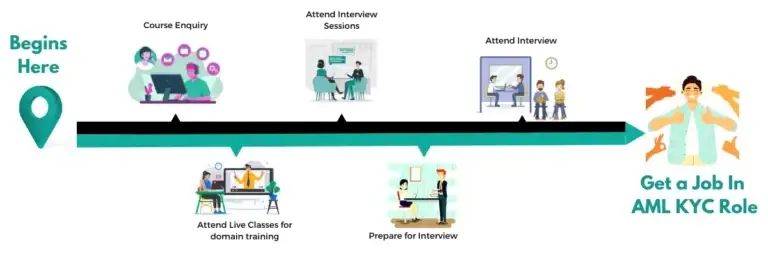

Career Advice!

Feel Free to Contact Us or WhatsApp Us for Career Counseling!

- +91 9066508122

Top 30 DevOps Interview Questions & Answers (2022 Update)

Top 30 DevOps Interview Questions & Answers (2022 Update) Top...

Read MoreAnti Money Laundering Interview Questions

Anti Money Laundering Interview Questions Anti Money Laundering Interview Questions...

Read More