Data Science Interview Questions Data Science Interview Questions 1. What...

Read MoreAML in Banking & Financial Institutions

Last Updated on Feb 12, 2026, 2k Views

AML in Banking & Financial Institutions

AML (Anti-Money Laundering) refers to laws, regulations, and procedures designed to prevent criminals from disguising illegally obtained funds as legitimate income.

Banks and financial institutions are the primary gatekeepers of the financial system, making AML compliance a critical function.

1️⃣ Why AML is Critical in Banking

Banks are vulnerable because they:

Handle large volumes of transactions

Offer cross-border transfers

Provide accounts, loans, investments, and trade finance

Enable digital and online payments

Without AML controls, banks can be used for:

Money laundering

Terrorist financing

Fraud and corruption

Tax evasion

Sanctions evasion

Regulatory penalties for non-compliance can include:

Heavy monetary fines

License cancellation

Criminal liability

Severe reputational damage

2️⃣ Key AML Regulations (India + Global Context)

🇮🇳 India

Prevention of Money Laundering Act (PMLA), 2002

RBI AML/KYC Master Directions

Financial Intelligence Unit – India (FIU-IND)

🌍 Global

FATF (Financial Action Task Force) Recommendations

USA PATRIOT Act (U.S.)

EU AML Directives

Basel Committee Guidelines

3️⃣ Core AML Components in Banks

1. Customer Due Diligence (CDD)

Also called KYC (Know Your Customer).

Includes:

Customer identification & verification

Address proof & identity proof

Beneficial ownership identification

Risk categorization (Low/Medium/High risk)

Enhanced Due Diligence (EDD) for:

Politically Exposed Persons (PEPs)

High-risk countries

High-value clients

2. Transaction Monitoring

Banks use automated systems to detect suspicious patterns like:

Large cash deposits

Structuring (smurfing)

Rapid movement of funds

Unusual international transfers

Transactions inconsistent with customer profile

3. Suspicious Transaction Reporting (STR)

If suspicious activity is detected:

Bank files STR with FIU-IND (in India)

Confidential process (customer not informed)

Mandatory reporting timelines

4. Sanctions Screening

Screening against:

UN sanctions lists

OFAC lists

Domestic watchlists

Terrorist databases

5. Record Keeping

Maintain customer records for 5–10 years

Maintain transaction history

Ensure audit trails

6. Ongoing Monitoring

AML is not a one-time process.

Banks must:

Periodically update KYC

Reassess risk

Monitor unusual behavior continuously

4️⃣ AML Risk Categories in Banking

Retail Banking

Corporate Banking

Correspondent Banking

Trade Finance

Private Banking

Digital/Neo Banks

Cryptocurrency exposure

Each carries different risk levels.

5️⃣ Roles & Responsibilities

Roles :

Board of Directors

Board of Directors

AML Analysts

Relationship Managers

Relationship Managers

Responsibilities:

Approve AML policy

Oversee AML program

Investigate alerts

Perform CDD

Test AML controls

6️⃣ Technology in AML

Modern banks use:

AI & Machine Learning

Behavioral analytics

Name screening tools

Transaction monitoring systems

Case management systems

7️⃣ Challenges in Banking AML

False positives in monitoring

Cross-border regulatory differences

Increasing digital fraud

Shell companies & layered transactions

Cryptocurrency risks

8️⃣ Consequences of AML Failure (Examples)

Major global banks have paid billions in fines for:

Weak monitoring systems

Failure to report suspicious activity

Sanctions violations

Summary

AML in banking ensures:

✔ Financial system integrity

✔ Prevention of crime & terrorism

✔ Regulatory compliance

✔ Institutional reputation protection

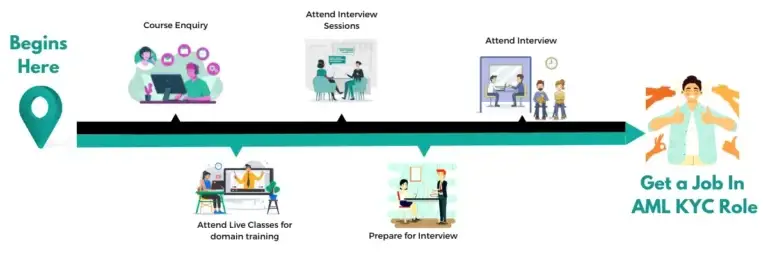

Career Advice!

Feel Free to Contact Us or WhatsApp Us for Career Counseling!

- +91 9066508122

Top 30 DevOps Interview Questions & Answers (2022 Update)

Top 30 DevOps Interview Questions & Answers (2022 Update) Top...

Read MoreAnti Money Laundering Interview Questions

Anti Money Laundering Interview Questions Anti Money Laundering Interview Questions...

Read More