Data Science Interview Questions Data Science Interview Questions 1. What...

Read MoreAML Compliance – Best Practices

Last Updated on Feb 13, 2026, 2k Views

AML Compliance – Best Practices

AML Compliance – Best Practices

Anti-Money Laundering (AML) compliance is essential for banks, financial institutions, and non-financial businesses to prevent money laundering and terrorist financing. Globally, AML frameworks are guided by standards set by the Financial Action Task Force (FATF).

Below are key AML compliance best practices applicable across industries:

1. Strong AML Governance & Tone at the Top

Establish a clear AML policy approved by the Board.

Appoint a qualified AML Compliance Officer (Money Laundering Reporting Officer – MLRO).

Ensure senior management oversight and accountability.

Conduct regular independent AML audits.

2. Risk-Based Approach (RBA)

Perform enterprise-wide AML risk assessments.

Classify customers as Low, Medium, or High risk.

Apply enhanced controls to higher-risk categories.

Update risk assessments periodically or upon major changes.

3. Customer Due Diligence (CDD) & KYC

Verify customer identity using reliable documentation.

Understand the nature and purpose of the relationship.

Identify Ultimate Beneficial Owners (UBOs).

Conduct Enhanced Due Diligence (EDD) for:

Politically Exposed Persons (PEPs)

High-risk jurisdictions

Complex ownership structures

4. Ongoing Monitoring & Transaction Surveillance

Implement automated transaction monitoring systems.

Monitor unusual or suspicious activity.

Update customer information regularly.

File Suspicious Transaction Reports (STRs) promptly when required.

5. Sanctions & Watchlist Screening

Screen customers and transactions against:

United Nations Security Council sanctions lists

Office of Foreign Assets Control (OFAC) lists

Domestic regulatory watchlists

Conduct real-time screening for new and existing customers.

6. Record Keeping & Documentation

Maintain KYC and transaction records for the legally required period.

Ensure audit trails are clear and retrievable.

Protect data confidentiality and integrity.

7. Employee Training & Awareness

Provide regular AML training to all staff.

Conduct role-specific training for high-risk departments.

Test employee understanding through assessments.

8. Independent Testing & Internal Audit

Conduct periodic independent AML reviews.

Address identified gaps promptly.

Implement corrective action plans.

9. Reporting & Regulatory Compliance

Timely submission of:

Suspicious Activity Reports (SAR/STR)

Currency Transaction Reports (CTR), if applicable

Maintain effective communication with regulators.

10. Use of Technology & Data Analytics

Deploy AI-driven transaction monitoring.

Use behavioral analytics for risk scoring.

Maintain cybersecurity safeguards to protect AML systems.

Industry-Specific Considerations

For Banks & Financial Institutions

Strong correspondent banking due diligence

Trade-based money laundering controls

Cross-border risk monitoring

For Non-Financial Businesses (DNFBPs)

Real estate transaction transparency

Monitoring of high-value cash transactions

Vendor and third-party risk screening

Key Success Factors

Culture of compliance

Clear documentation

Continuous improvement

Alignment with global standards (e.g., FATF recommendations)

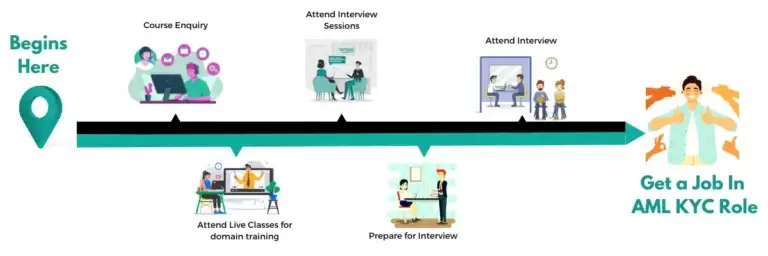

Career Advice!

Feel Free to Contact Us or WhatsApp Us for Career Counseling!

- +91 9066508122

Top 30 DevOps Interview Questions & Answers (2022 Update)

Top 30 DevOps Interview Questions & Answers (2022 Update) Top...

Read MoreAnti Money Laundering Interview Questions

Anti Money Laundering Interview Questions Anti Money Laundering Interview Questions...

Read More