Data Science Interview Questions Data Science Interview Questions 1. What...

Read MoreAI & Machine Learning in AML Monitoring

Last Updated on Feb 17, 2026, 2k Views

AI & Machine Learning in AML Monitoring

AI & Machine Learning in AML Monitoring

Artificial Intelligence (AI) and Machine Learning (ML) are transforming Anti-Money Laundering (AML) monitoring by making systems smarter, faster, and more accurate. Traditional rule-based systems often generate high false positives and struggle to detect evolving financial crime patterns. AI-driven AML solutions address these limitations with advanced analytics and predictive modeling.

Why AI is Important in AML Monitoring

Financial institutions face increasing regulatory pressure from global bodies like the Financial Action Task Force (FATF) and must comply with local regulations such as:

Prevention of Money Laundering Act (India)

Bank Secrecy Act (USA)

Traditional monitoring systems:

Depend on static rules

Require manual threshold tuning

Generate excessive false alerts

Struggle with complex transaction patterns

AI enhances AML programs by enabling real-time, risk-based monitoring.

Key Applications of AI & ML in AML

1. Transaction Monitoring Optimization

Machine learning models analyze historical transaction data to:

Identify unusual patterns

Detect anomalies in customer behavior

Reduce false positives

Prioritize high-risk alerts

Unlike rule-based systems, ML adapts to new typologies without constant manual updates.

2. Customer Risk Scoring

AI improves KYC and CDD by:

Dynamically assessing customer risk profiles

Incorporating behavioral analytics

Using predictive modeling to detect high-risk customers early

This supports risk-based approaches recommended by global regulators.

3. Suspicious Activity Detection

Supervised learning models are trained on previously filed Suspicious Activity Reports (SARs) to:

Predict suspicious transactions

Identify layering and structuring patterns

Detect mule accounts and synthetic identities

4. Network & Graph Analytics

AI-powered graph databases map relationships between:

Individuals

Shell companies

Cross-border accounts

This helps uncover hidden networks involved in trade-based money laundering, terrorist financing, and fraud.

5. NLP for Adverse Media Screening

Natural Language Processing (NLP) tools:

Scan global news and sanctions lists

Identify negative news related to customers

Automate name screening processes

AI reduces manual compliance workload significantly.

Types of Machine Learning Used in AML

Supervised Learning

Uses labeled historical data

Effective for SAR prediction

Examples: Logistic regression, Random forests, Neural networks

Unsupervised Learning

Detects anomalies without labeled data

Useful for new typologies

Examples: Clustering, Isolation Forest

Semi-Supervised Learning

Combines both approaches

Useful when labeled data is limited

Benefits of AI in AML Monitoring

✔ Reduced false positives

✔ Faster investigations

✔ Better risk prioritization

✔ Enhanced detection accuracy

✔ Real-time monitoring capabilities

✔ Cost efficiency in compliance operations

Challenges of AI in AML

Data quality issues

Model explainability (regulatory concern)

Bias and fairness risks

Integration with legacy systems

High implementation costs

Regulators increasingly expect explainable AI models rather than “black-box” systems.

Future Trends in AI-Driven AML (2026 & Beyond)

AI-powered regulatory reporting automation

Federated learning for privacy-preserving AML collaboration

Integration of blockchain analytics

Real-time cross-border monitoring systems

Explainable AI (XAI) frameworks for audit transparency

Conclusion

AI and Machine Learning are reshaping AML monitoring by moving beyond static rule-based systems toward intelligent, adaptive compliance frameworks. While challenges remain, AI adoption is becoming essential for financial institutions to stay compliant, competitive, and resilient against increasingly sophisticated financial crimes.

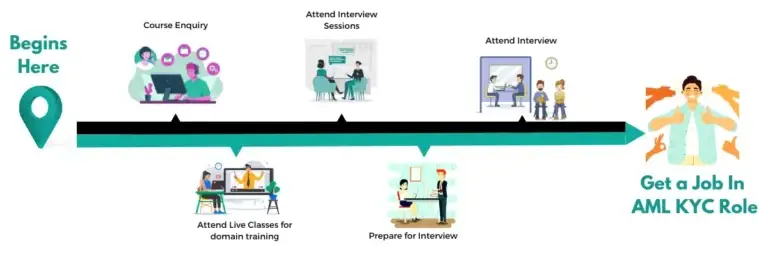

Career Advice!

Feel Free to Contact Us or WhatsApp Us for Career Counseling!

- +91 9066508122

Top 30 DevOps Interview Questions & Answers (2022 Update)

Top 30 DevOps Interview Questions & Answers (2022 Update) Top...

Read MoreAnti Money Laundering Interview Questions

Anti Money Laundering Interview Questions Anti Money Laundering Interview Questions...

Read More