Data Science Interview Questions Data Science Interview Questions 1. What...

Read MoreThe 3 Stages of Money Laundering with Real Examples

Last Updated on Feb 18, 2026, 2k Views

The 3 Stages of Money Laundering with Real Examples

The 3 Stages of Money Laundering (With Real-World Examples)

Money laundering is the process of disguising illegally obtained funds so they appear legitimate. Regulators worldwide—including the Financial Action Task Force (FATF)—recognize three core stages of money laundering:

Placement

Layering

Integration

Let’s break down each stage with practical examples.

1️⃣ Placement Stage

What It Is:

Placement is the initial stage where illicit money is introduced into the financial system.

Criminals try to avoid detection by:

Depositing cash in small amounts (structuring/smurfing)

Using cash-intensive businesses

Converting cash into monetary instruments

Real Example:

In the case involving Sinaloa Cartel, drug proceeds were often smuggled in bulk cash and deposited in smaller structured amounts into U.S. bank accounts to avoid reporting thresholds.

Another example: A corrupt official channels bribe money into a chain of restaurants he owns, falsely reporting the cash as daily sales revenue.

Red Flags:

Frequent cash deposits just below reporting limits

Sudden spikes in cash activity

Use of third parties to deposit funds

2️⃣ Layering Stage

What It Is:

Layering involves complex financial transactions designed to obscure the origin of funds.

Criminals may:

Transfer money across multiple accounts

Use offshore companies

Convert funds into crypto assets

Trade high-value goods

Real Example:

In the Panama Papers investigation, numerous shell companies were used globally to hide beneficial ownership and move funds across jurisdictions, making it difficult to trace the true source of wealth.

Another example: Funds are transferred from a local bank account to an offshore account in a tax haven, then used to purchase luxury assets under a different company name.

Red Flags:

Complex ownership structures

Rapid international transfers

Transactions lacking clear economic purpose

3️⃣ Integration Stage

What It Is:

Integration is when the laundered money re-enters the economy appearing legitimate.

At this stage, funds may be used for:

Real estate purchases

Investments

Luxury assets

Business expansion

Real Example:

In the 1MDB scandal, misappropriated funds were allegedly used to purchase luxury real estate, artwork, and finance the Hollywood film The Wolf of Wall Street, integrating illicit funds into legitimate sectors.

Another example: A criminal invests layered funds into a construction company and later sells properties, showing profits as lawful business income.

Red Flags:

High-value asset purchases inconsistent with profile

Use of complex financing arrangements

Investments without logical business rationale

Why Understanding These Stages Matters

Authorities such as the Financial Crimes Enforcement Network (FinCEN) and regulators worldwide require institutions to monitor suspicious activity at all three stages.

An effective AML program includes:

Strong KYC & Customer Due Diligence (CDD)

Transaction monitoring systems

Suspicious Activity Reporting (SAR)

Ongoing risk assessment

Quick Summary Table

| Stage | Objective | Common Methods | Key Risk Indicator |

|---|---|---|---|

| Placement | Introduce illegal funds | Cash structuring, front businesses | Frequent small deposits |

| Layering | Obscure origin | Offshore transfers, shell companies | Complex transactions |

| Integration | Make funds appear legitimate | Real estate, investments | Wealth inconsistent with profile |

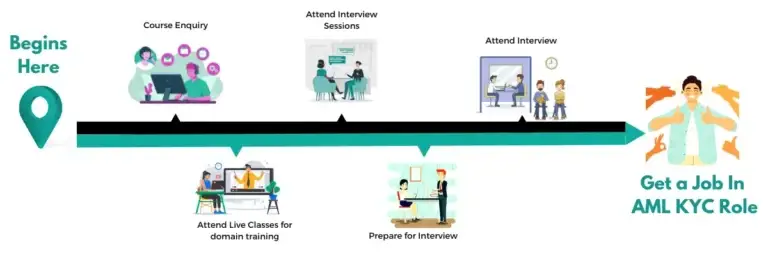

Career Advice!

Feel Free to Contact Us or WhatsApp Us for Career Counseling!

- +91 9066508122

Top 30 DevOps Interview Questions & Answers (2022 Update)

Top 30 DevOps Interview Questions & Answers (2022 Update) Top...

Read MoreAnti Money Laundering Interview Questions

Anti Money Laundering Interview Questions Anti Money Laundering Interview Questions...

Read More