Data Science Interview Questions Data Science Interview Questions 1. What...

Read MoreDifference Between AML, KYC, and CDD Explained

Last Updated on Feb 18, 2026, 2k Views

Difference Between AML, KYC, and CDD Explained

Difference Between AML, KYC, and CDD Explained

In the world of financial compliance, AML, KYC, and CDD are closely connected—but they are not the same. Understanding how they differ (and how they work together) is essential for banks, fintech companies, DNFBPs, and other regulated entities.

1️⃣ Anti-Money Laundering (AML)

AML (Anti-Money Laundering) refers to the entire framework of laws, regulations, and procedures designed to prevent criminals from disguising illegally obtained funds as legitimate income.

Key Points:

Broad regulatory and compliance framework

Includes policies, internal controls, monitoring, reporting

Covers ongoing transaction monitoring and suspicious activity reporting

Enforced by national laws and global standards

Example Regulations:

Bank Secrecy Act (USA)

Prevention of Money Laundering Act (India)

Financial Action Task Force global AML standards

👉 AML is the umbrella framework.

2️⃣ Know Your Customer (KYC)

KYC (Know Your Customer) is a process within AML focused on verifying a customer’s identity before establishing a business relationship.

Key Objectives:

Confirm customer identity

Prevent identity fraud

Ensure customers are legitimate

Typical KYC Checks:

Government-issued ID verification

Address proof

PAN / Tax ID validation

Biometric verification (in some jurisdictions)

👉 KYC is about identity verification at onboarding.

3️⃣ Customer Due Diligence (CDD)

CDD (Customer Due Diligence) goes beyond basic identity verification. It assesses the risk level of a customer and evaluates whether their profile matches their financial behavior.

CDD Includes:

Understanding source of funds

Identifying beneficial ownership

Risk profiling (low, medium, high risk)

Ongoing monitoring

CDD is risk-based and may escalate to Enhanced Due Diligence (EDD) for high-risk customers such as:

Politically Exposed Persons (PEPs)

Customers from high-risk jurisdictions

Complex corporate structures

👉 CDD evaluates customer risk and monitors behavior.

🔎 Quick Comparison Table

| Aspect | AML | KYC | CDD |

|---|---|---|---|

| Scope | Broad compliance framework | Identity verification process | Risk assessment process |

| Stage | Ongoing | At onboarding | Onboarding + ongoing |

| Focus | Prevent money laundering | Verify identity | Assess and manage risk |

| Includes | Monitoring, reporting, controls | ID & document checks | Risk profiling, source of funds |

📌 How They Work Together

Think of it this way:

AML = The complete compliance system

KYC = Confirm who the customer is

CDD = Assess how risky the customer is

Without KYC, you don’t know who the customer is.

Without CDD, you don’t know their risk level.

Without AML, there’s no structured system to prevent financial crime.

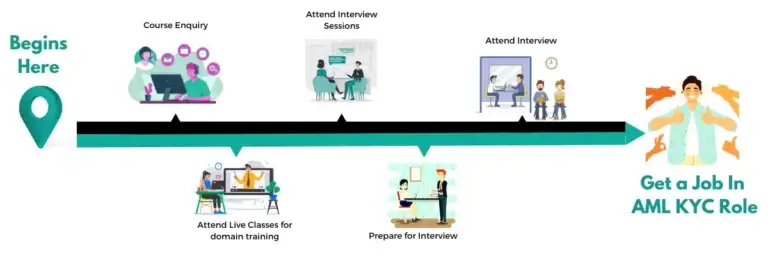

Career Advice!

Feel Free to Contact Us or WhatsApp Us for Career Counseling!

- +91 9066508122

Top 30 DevOps Interview Questions & Answers (2022 Update)

Top 30 DevOps Interview Questions & Answers (2022 Update) Top...

Read MoreAnti Money Laundering Interview Questions

Anti Money Laundering Interview Questions Anti Money Laundering Interview Questions...

Read More