Data Science Interview Questions Data Science Interview Questions 1. What...

Read MoreAML in Non-Financial Businesses

Last Updated on Feb 12, 2026, 2k Views

AML in Non-Financial Businesses

1️⃣ What is Money Laundering?

Money laundering is the process of making illegally obtained money appear legitimate. It usually happens in three stages:

Placement – Introducing illegal money into the system

Layering – Moving money through multiple transactions to hide its origin

Integration – Reintroducing the money as “clean” funds

Non-financial businesses are often used in the placement and integration stages.

2️⃣ Which Non-Financial Businesses Are Covered Under AML?

These are often called DNFBPs (Designated Non-Financial Businesses and Professions):

✔ Real Estate Agents

Property purchases are commonly used to launder large amounts of money.

✔ Lawyers & Notaries

Especially when handling:

Client funds

Company formation

Property transactions

✔ Accountants

Can unknowingly help structure transactions to hide funds.

✔ Company Formation Agents

Used to create shell companies.

✔ Casinos & Gaming Businesses

Cash-heavy operations are high risk.

✔ Dealers in High-Value Goods

Luxury cars

Jewelry

Art

Precious metals

High-end electronics

✔ Trust & Company Service Providers

3️⃣ AML Obligations for Non-Financial Businesses

Even if not a bank, businesses may be required to implement:

🔎 1. Customer Due Diligence (CDD)

- Verify identity (KYC – Know Your Customer)

- Understand nature of business relationship

- Identify beneficial owners

📄 2. Record Keeping

- Maintain customer records

- Keep transaction documentation (usually 5–10 years)

🚨 3. Suspicious Transaction Reporting (STR)

- Report suspicious activities to authorities (FIU – Financial Intelligence Unit)

⚖ 4. Risk-Based Approach

- Conduct AML risk assessment

- Apply enhanced due diligence for high-risk customers

📚 5. Internal Controls

- Appoint AML compliance officer

- Staff training

- Written AML policies & procedures

4️⃣ Why AML Matters for Non-Financial Businesses

Failure to comply can result in:

Heavy fines

Criminal penalties

Business license suspension

Reputational damage

Regulators globally (FATF guidelines) require countries to monitor non-financial sectors due to increasing misuse.www

5️⃣ Common Red Flags in Non-Financial Businesses

Examples include:

Customers insisting on large cash payments

Use of complex company structures without clear purpose

Transactions inconsistent with client profile

Reluctance to provide identification

Rapid resale of property at unusual prices

6️⃣ Example Scenario

A real estate agent receives ₹2 crore in cash for a property purchase.

If the buyer refuses to disclose source of funds, the agent must:

Conduct enhanced due diligence

Verify identity and source of funds

File a Suspicious Transaction Report if needed

7️⃣ Global & Indian Context (if applicable)

In India, AML is governed by:

Prevention of Money Laundering Act (PMLA), 2002

Regulated by:

FIU-IND

RBI (for financial entities)

Other sector regulators

Certain non-financial businesses fall under reporting obligations under PMLA.

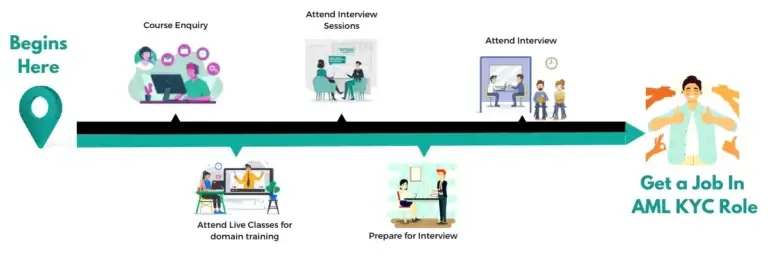

Career Advice!

Feel Free to Contact Us or WhatsApp Us for Career Counseling!

- +91 9066508122

Top 30 DevOps Interview Questions & Answers (2022 Update)

Top 30 DevOps Interview Questions & Answers (2022 Update) Top...

Read MoreAnti Money Laundering Interview Questions

Anti Money Laundering Interview Questions Anti Money Laundering Interview Questions...

Read More