Data Science Interview Questions Data Science Interview Questions 1. What...

Read MoreCorporate Due Diligence Interview Question and Answers

Last Updated on Sep 1, 2025, 2k Views

Corporate Due diligence interview question and answers

1. What is corporate due diligence, and why is it important?

Answer:

Corporate due diligence is the process of gathering and analyzing information about a company, its owners, management, and business activities to assess financial, legal, and reputational risks. It ensures that corporates do not enter into relationships with high-risk entities, sanctioned parties, or companies involved in financial crime. It is critical for regulatory compliance, safeguarding reputation, and making informed business decisions.

2. What are the key elements you review during corporate due diligence?

Answer:

Corporate documents – Certificate of incorporation, business licenses.

Ownership & control – Ultimate Beneficial Owners (UBOs).

Directors & shareholders – Background checks, PEP status.

Sanctions & Watchlists – OFAC, UN, EU, UK HMT, local lists.

Adverse media – Negative news on corruption, fraud, money laundering.

Geographic risk – Presence in high-risk or sanctioned countries.

Financials – Unusual structures or red flags in business activities.

3. How do you identify and verify Ultimate Beneficial Owners (UBOs)?

Answer:

I review corporate registries, company filings, and supporting documents like shareholder registers. If ownership chains involve multiple layers, I trace them until the natural person(s) owning or controlling 25% or more (or lower, depending on regulation) are identified. Where documentation is unclear, I escalate for enhanced due diligence.

4. What are red flags during corporate due diligence?

Answer:

Complex or opaque ownership structures.

Shareholders registered in offshore secrecy jurisdictions.

Frequent changes in directors/shareholders.

Adverse media linking the company or its owners to corruption, fraud, or crime.

Inconsistencies in company filings vs. business operations.

Ties to sanctioned countries or high-risk sectors (e.g., arms trade, gambling).

5. What’s the difference between Customer Due Diligence (CDD) and Enhanced Due Diligence (EDD)?

Answer:

CDD: Basic verification of corporate documents, ownership, and sanctions screening. Used for low-to-medium risk clients.

EDD: Deeper investigation involving source of wealth/funds, site visits, detailed background checks, and ongoing monitoring. Required for high-risk clients such as PEP-linked entities, companies in high-risk jurisdictions, or those with unusual ownership structures.

6. How do you conduct due diligence on foreign companies?

Answer:

Accessing official registries in the country of incorporation.

Using third-party data providers (World-Check, Orbis, Dow Jones, LexisNexis).

Reviewing translated corporate documents if necessary.

Checking for cross-border sanctions exposure.

If documents are limited, applying enhanced due diligence (including open-source checks and legal confirmations).

7. What tools and databases have you used for due diligence?

Answer:

Examples: Orbis (BvD), World-Check, Dow Jones Risk & Compliance, LexisNexis, Factiva, Refinitiv, and official government registries. Also, in-house KYC platforms for workflow and document storage.

8. How do you handle adverse media findings during due diligence?

Answer:

Assess credibility of the source (reputable news, court filings vs. blogs).

Determine if the issue is material and ongoing.

Check if it directly involves the corporate or just associated parties.

Escalate to compliance/legal for risk decision if findings indicate potential reputational, financial, or regulatory risks.

9. What are regulatory requirements for corporate due diligence?

Answer:

FATF Recommendations: UBO identification, risk-based approach.

EU AML Directives (AMLD): Transparency registers for beneficial owners.

OFAC/UN/EU/UK sanctions compliance.

Local AML/KYC laws: Country-specific requirements (e.g., PMLA in India, FinCEN in US).

10. How do you ensure ongoing due diligence after onboarding a corporate client?

Answer:

Periodic reviews (frequency depends on risk rating).

Continuous sanctions and PEP screening.

Monitoring adverse media for new risks.

Updating UBO and corporate documents when changes occur.

Enhanced monitoring for high-risk clients.

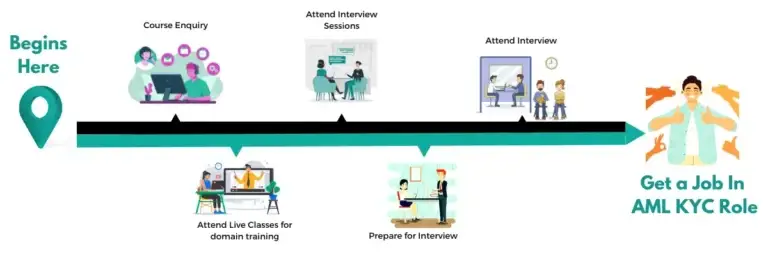

Career Advice!

Feel Free to Contact Us or WhatsApp Us for Career Counseling!

- +91 9066508122

Top 30 DevOps Interview Questions & Answers (2022 Update)

Top 30 DevOps Interview Questions & Answers (2022 Update) Top...

Read MoreAnti Money Laundering Interview Questions

Anti Money Laundering Interview Questions Anti Money Laundering Interview Questions...

Read More