Data Science Interview Questions Data Science Interview Questions 1. What...

Read MoreIncreasing AML Compliance Obligations in the Cryptocurrency Industry

Last Updated on Aug 12, 2025, 2k Views

Increasing AML Compliance Obligations in the Cryptocurrency Industry

1. Why AML Compliance in Crypto is Tightening

The cryptocurrency industry has seen a rapid increase in regulatory oversight due to:

Rising illicit use of digital assets for money laundering, terrorist financing, and ransomware.

Global pressure from the Financial Action Task Force (FATF) to implement the “Travel Rule” and other AML standards.

High-profile enforcement cases involving exchanges and crypto service providers.

Mainstream adoption by institutional investors and banks, driving alignment with traditional finance rules.

2. Key Areas of Increasing AML Obligations

A. Regulatory Expansion

Travel Rule Compliance

FATF now expects Virtual Asset Service Providers (VASPs) to collect, verify, and transmit sender and receiver information for transactions over a certain threshold.Beneficial Ownership Transparency

More jurisdictions are requiring disclosure of ultimate beneficial owners (UBOs) for crypto businesses and accounts.KYC for DeFi & NFTs

Regulators are expanding AML/KYC rules beyond centralized exchanges to cover decentralized platforms, NFT marketplaces, and stablecoin issuers.

B. Enhanced Customer Due Diligence (CDD)

Risk-based onboarding for individuals and corporate clients, especially those from high-risk jurisdictions.

Ongoing monitoring for suspicious wallet addresses and blockchain activity.

Screening against sanctions lists (OFAC, EU, UN) and PEP lists.

C. Blockchain Transaction Monitoring

Advanced analytics tools like Chainalysis, TRM Labs, Elliptic are becoming essential for:

Detecting suspicious transaction patterns.

Identifying mixers, tumblers, and high-risk wallets.

Flagging links to darknet markets or sanctioned entities.

Regulators expect continuous and retrospective monitoring.

D. Reporting Obligations

Suspicious Activity Reports (SARs) must be filed for questionable transactions, just as in traditional banking.

Cross-border transaction reporting is increasingly required.

Recordkeeping requirements are being harmonized with traditional finance — in many countries, crypto firms must keep records for 5–10 years.

3. Enforcement Trends

Hefty penalties: In 2024–2025, several crypto exchanges faced fines exceeding $1B for AML failures.

Licensing revocations: Regulators have shut down VASPs failing to meet AML standards.

Executive liability: More cases are holding CEOs and compliance officers personally accountable.

4. Global Developments

| Region | Key Update |

|---|---|

| US | FinCEN expanding AML rules to include mixers, privacy coins, and certain DeFi operators. |

| EU | New AMLA authority to directly supervise large crypto entities under AMLD6. |

| UK | FCA tightening registration and ongoing compliance checks for crypto firms. |

| Asia-Pacific | Singapore, Japan, and Hong Kong enforcing Travel Rule and licensing requirements. |

| Middle East | UAE and Bahrain enhancing crypto AML audits under VARA and CBB rules. |

5. Industry Impact

Higher compliance costs for crypto firms.

Shift toward regulated, transparent operations to maintain banking relationships.

Innovation in RegTech — more firms integrating AI-powered KYC and blockchain analytics.

6. Strategic Recommendations for Crypto Businesses

Adopt Travel Rule-ready solutions.

Implement real-time blockchain monitoring.

Enhance risk-based KYC procedures.

Conduct independent AML audits.

Train staff regularly on emerging crypto risks.

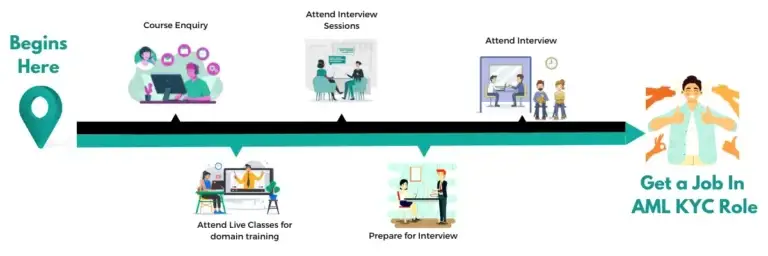

Career Advice!

Feel Free to Contact Us or WhatsApp Us for Career Counseling!

- +91 9066508122

Top 30 DevOps Interview Questions & Answers (2022 Update)

Top 30 DevOps Interview Questions & Answers (2022 Update) Top...

Read MoreAnti Money Laundering Interview Questions

Anti Money Laundering Interview Questions Anti Money Laundering Interview Questions...

Read More